Consumer response to walk-in clinics or retail clinics has been optimistic, which has led to an upsurge in the number of retail clinics in recent past, witnessing robust growth and outlet scope. According to a survey conducted in the US in 2016,

- More than 36% of the retail clinic customer pool was satisfied with the services and other aspects of walk-in clinics.

- Approximately 54% of the adult population that first visited a retail clinic highly recommend the services provided by retail clinics.

- A negligible percentage among them reported that they were not satisfied with the offerings of retail clinics.

On the other side, according to a recent Walmart Survey, nearly 90% of the customers were satisfied with retail clinics and the high satisfaction level has been attributed to cost transparency, surpassing the conventional benefit of cost efficiency.

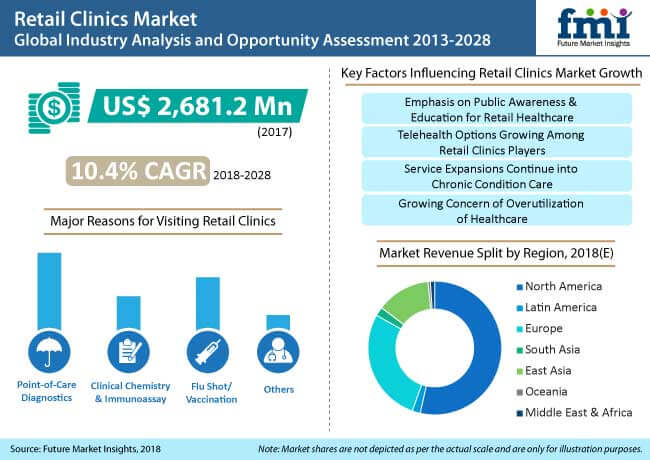

According to a recent study, the global market for retail clinics will grow at a strong CAGR of over 10% during 2018-2028 and is likely to continue most prominent expansion in the US owing to positive consumer demand response within a short span of time.

Increasing Number of Retail Clinics and Rising Frequency of Visits for Low-Acuity Medical Conditions

Retail clinics have been considered by insurers and policy makers as an alternative way to reduce healthcare spending. Clinic visits cost way less than physician office or emergency department visits. According to a survey conducted by the RAND organization, approximately 58% of retail clinic visits account for low-acuity conditions that represent new utilization.

Request Sample Report @ https://www.futuremarketinsights.com/reports/sample/rep-gb-9254

The use of retail clinics is associated with a decent increment in healthcare spending. Similar researches and studies around the globe have shown that approximately 40% of retail clinic visits are for minor medical issues. This increase in spending from higher use of services outweighs the savings generated when consumers went to less expensive retail clinics instead of an emergency room or a doctor's office.

In the US, where retail clinics are extremely widespread, the first retail clinics opened in Minnesota in 2000. However, as per the RAND study conducted in November 2011, the number of retail clinics increased by a factor of 12 between 2006 and 2010. Retail clinic visits, majorly for low-acuity conditions, have led to an increase in spending and utilization, further fuelling demand growth of the retail clinics market during the forecast period.

Growth of Retail Clinics in Vaccination Delivery

Retail clinics have shown promising growth in vaccination delivery, majorly in the United States. Vaccinations hold a substantial share of the retail clinics business. The trend of vaccination delivery has observed decent growth in the overall market for retail clinics. However, retail clinics could deliver more vaccinations and increase their overall business if the vaccination histories are reviewed and the patients are counselled on the advantages of vaccination during acute care visits.

Retail clinics are considered to be a promising venue both for promoting and administering vaccinations. As most retail clinics are located in popular locations, such as hypermarkets, supermarkets, grocery stores, the advertising and promotion of vaccinations becomes easy.

Increase in Healthcare Expenditure

Globally, the per capita spending on healthcare has been increasing. People’s desire and ability to spend on wellness have led to an incremental shift in healthcare expenditure, which is expected to boost the growth of medical and healthcare industries, and subsequently, medical treatment in the near future. Within a span of 10 years, the global per capita healthcare spending has almost doubled, owing to the increasing awareness regarding the availability of treatment options in the market.

For instance, healthcare expenditure in percentage with GDP grew from 17.2% to 17.3% from 2016 to 2018 in the US. Europe has been registering a consistent increase in healthcare expenditure in regions such as France, Germany, the Netherlands, Denmark and Switzerland and had a GDP% healthcare expenditure of 11.7%, 11.3%, 12.9%, 10.6% and 11.5% respectively.

Definition

Retail clinics are also termed as walk-in clinics, owing to the convenience they provide to patients. These clinics are located inside retail stores, such as department stores, hypermarkets and supermarkets. Retail clinics come under a broader category termed as convenient care centres. Retail clinics take care of different injuries and illnesses. In addition, majority of medical conditions that are treated at any traditional facility, could also be treated at these retail clinics.

About the Report

FMI conducted a research study on the retail clinics market for the forecast period 2018 to 2028. The report offers a comprehensive evaluation of the business opportunities prevailing in the retail clinics market, along with insights on the retail clinics market value analysis base by region, market trends, pricing analysis based on service type, reimbursement scenario, target population for retail clinics, consumer sentiment analysis, existing models for retail clinics, and costs per patient visit comparison. The retail clinics market report elaborates on the macro-economic factors influencing the dynamics of the market, and its futuristic potential.

Request to View Methodology @ https://www.futuremarketinsights.com/askus/rep-gb-9254

Retail Clinics Market: Segmentation

The report on the retail clinics market offers a comprehensive taxonomy of the retail clinics market based on application, distribution channel, ownership type, and region.

- The retail clinics market, on the basis of application, has been segmented as point-of-care diagnostics, clinical chemistry and immunoassay, vaccinations, and others.

- By distribution channel, the retail clinics market has been segmented into retail pharmacies, drug stores, and grocery chain and big box stores.

- By ownership type, the retail clinics market has been segmented into retail-owned retail clinics and hospital-owned retail clinics.

No comments:

Post a Comment